Ecommerce and Retail • Neto

In the first post in our series with eWAY on cyber security in ecommerce we covered off on some of the main causes of cyber attack and some simple measures you can implement in your business to protect yourself. Today, eWAY’s Helgard DeLange will take a look at the rise of payment fraud in ecommerce and what it means for you.

Between April and June 2017, over 11,800 people reported incidents of cybercrime to the Australian Cybercrime Online Reporting Network. Alongside personal information being hacked, an area of particular concern to online business owners is the issue of payment fraud–and according to Juniper Research, card-not-present (CNP) transactions account for 60-70% of all card fraud in developed countries.

Payment fraud is any type of false, illegal or unauthorised transaction that happens on the internet where the ‘Cyber Criminal’ steals the victim’s money, personal property, or sensitive information.

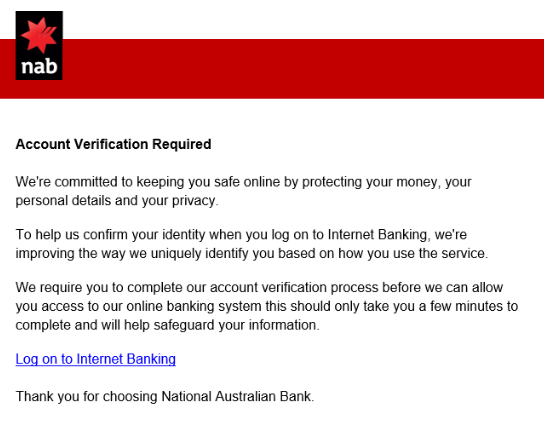

Cyber Criminals look for glitches, gaps or patches in your software systems and might use any of the following methods to gain access to personal data, often posing as someone from your bank:

Card fraud is when someone uses information from a credit card to complete a transaction that is not authorised by the account holder.

There are two main types of payment fraud you should be aware of; card present and card not present transactions.

‘Card present’ fraud is when a criminal actually gets their hands on your credit card to make a fraudulent transaction at an ATM or point of sale.

‘Card not present’ fraud is when credit card details are obtained and used to make purchases or payments without the card, which typically occur online. This is the most common type of fraud in Australia, accounting for 82% of all card fraud in the last financial year. Not surprisingly, this type of fraud has risen dramatically in tandem with online shopping and digital business.

Some of the different types of fraudulent payments include:

Here are a few reliable ways you can protect your business and customers from fraud losses:

Just like any ecommerce business owner, you budget for a certain amount of product being purchased on your website over a certain time period. You allocate time and money to building the site and purchasing your product, and just like contents insurance for a bricks-and-mortar store, you want to ensure your assets and income are protected.

At the same time, past, current and future customers want to have trust and confidence that the payment information they hand over to you is kept safe, secure and confidential.

That’s why it’s worth implementing the above practices and investing in cyber security.

Making an investment in cyber security offers more than assurance of retaining your current income – it also offers you the potential to open doors to new customers, therefore increasing both your client database and profit margin.

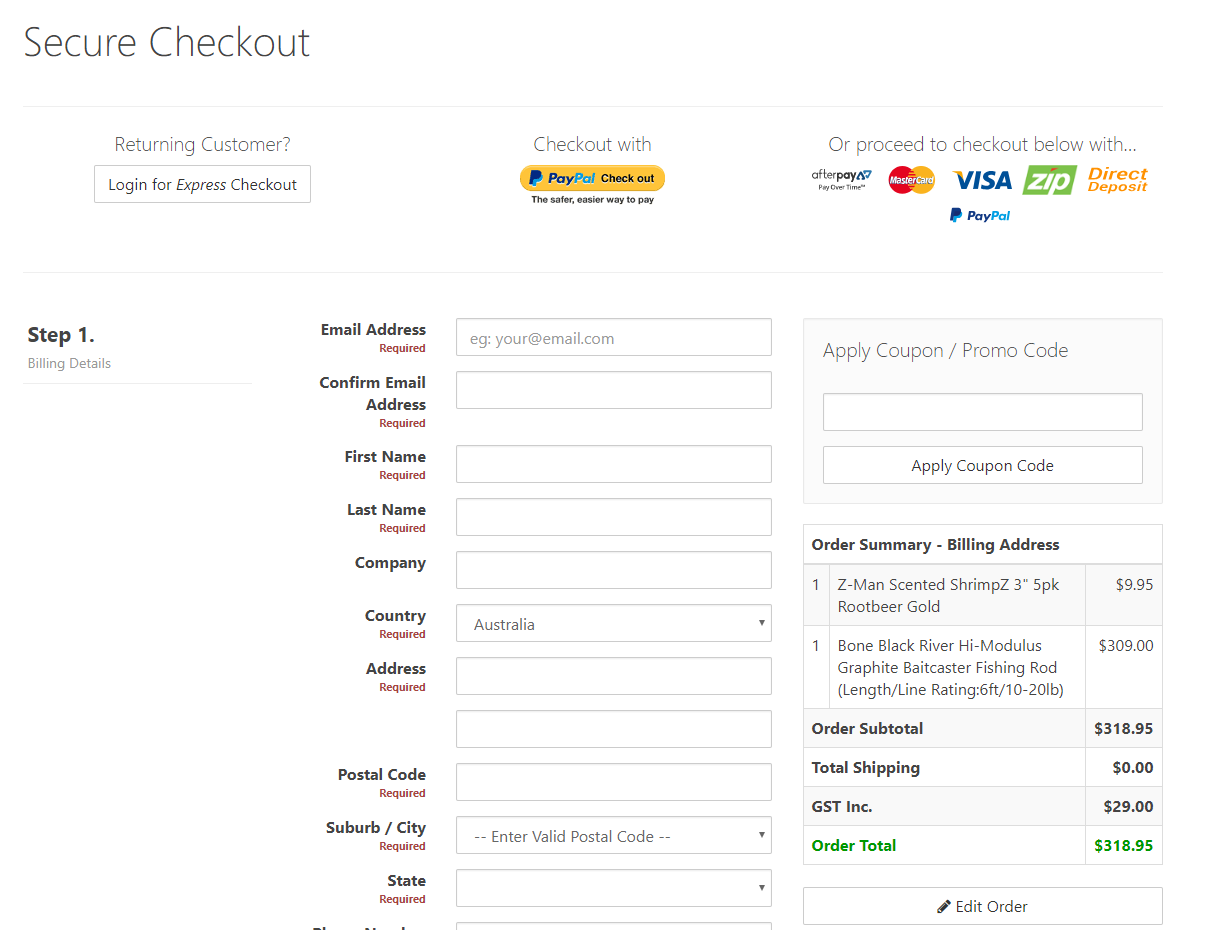

Fortunately, securing your shopping cart system and ecommerce business against fraud isn’t difficult.

For any ecommerce business, a secure shopping cart system is critical. Financial transactions are the end of the customer’s purchasing journey with you, and they want the assurance of handing their money and personal information over to a company that’s actively invested in handling it in a secure and professional manner.

Financially, a secured cart system also ensures your payments are collected safely and will provide the features needed to process credit cards and connect directly to bank accounts, working in tandem with leading payment gateways to provide customers with a seamless transaction without having them leave the platform.

Safeguarding your shopping cart with the appropriate ecommerce or retail management software will not only secure customers’ personal information, but can help you streamline business operations by offering features for shipping requirements, order and inventory management, strategic marketing and customer support.

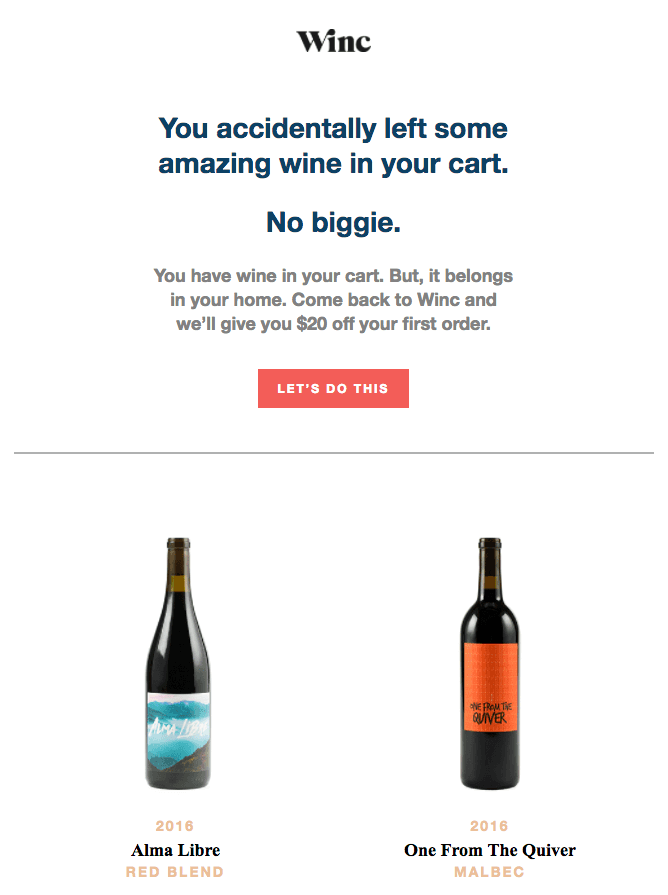

From a marketing perspective, a customisable cart system also has the potential to incorporate a range of strategies to increase revenue and continue relationships with past purchasers.

Offering discounts on items that have been previously abandoned in carts, creating wish lists or even using discount or coupon codes are all advanced functionalities of a cart system that can help you retain existing customers and entice new ones to purchase.

| Related Reading: 3 Emails to Increase Ecommerce Abandoned Cart Recovery in 2018

Neto provides a complete solution for ecommerce, point of sale, inventory and fulfilment, with a secure shopping cart system and secure payments providers, including eWAY. If you’re looking to optimise your online payments, improve security and reduce fraud risk, eWAY gives Neto merchants in-built fraud protection, fast settlement and 24 hour, local support—all for a low per transaction rate.

Fill in the form below to speak to one of the team at eWAY about their competitive rates or check out our recent webinar to learn more.